Harum: Strong Revenue Growth by Nickel, Despite Coal Price Decline

Introduction

PT Harum Energy Tbk (HRUM) has demonstrated robust revenue growth, primarily driven by its expanding nickel business, over the nine-month period ending September 30, 2024.

While facing headwinds from declining coal prices, the company’s strategic investments in the nickel sector have yielded significant gains.

This article delves into the company’s financial and operational highlights, offering a comprehensive analysis of its performance during the period. Revenues surged by 51% year-over-year to USD 970.2 million, while the nickel business unit made up the majority of the revenue.

Despite a significant increase in revenue, profit decreased by 34.8% to USD 94.5 million, compared to the same period in 2023.

Revenue and Profit

PT Harum Energy Tbk has seen substantial growth in overall revenue, reaching USD 970.2 million for the first nine months of 2024, a 51% increase compared to USD 642.4 million in the same period of 2023. This growth is largely attributable to the company’s strategic shift towards the nickel sector.

- Nickel’s Dominance: The nickel business unit has become a significant revenue driver, with total nickel revenues reaching USD 514.0 million for the nine-month period.

- Coal Revenue: While coal sales remain a part of the company’s portfolio, the average coal sales price decreased by 23.0% year-over-year from USD 120.1/t to USD 92.5/t.

- Profit Decline: Despite the impressive revenue growth, the company’s profit for the period decreased by 34.8% to USD 94.5 million, compared to USD 145.0 million in the same period of 2023. The company’s EBITDA also decreased by 15.8% to USD 234.3 million.

These figures highlight a significant transformation in PT Harum Energy Tbk’s revenue mix, with nickel taking the lead, despite decreasing profits.

Production Updates

PT Harum Energy Tbk has made significant strides in its production capabilities, particularly within the nickel business unit. The company’s operations encompass various stages of the nickel value chain, from mining to processing.

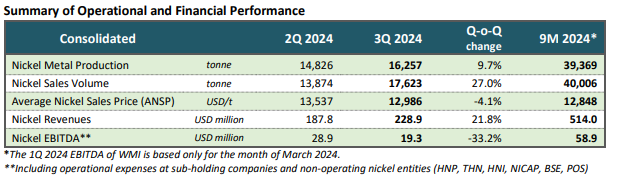

- Nickel Metal Production: Total nickel metal production for the first nine months of 2024 reached 39,369 tonnes. In the third quarter of 2024, production was 16,257 tonnes, a 9.7% increase compared to the second quarter of 2024.

- Nickel Sales Volume: The total nickel sales volume for the first nine months of 2024 was 40,006 tonnes. Sales volume increased by 27% quarter-on-quarter, from 13,874 tonnes in 2Q 2024 to 17,623 tonnes in 3Q 2024.

- Average Nickel Sales Price: The average nickel sales price for the nine-month period was USD 12,848/t. In the third quarter of 2024, the average nickel sales price was USD 12,986/t, a 4.1% decrease compared to the previous quarter.

- PT Infei Metal Industry (IMI): IMI sold 5,318 tons of nickel metal equivalent (in the form of nickel pig iron) during 3Q 2024, generating revenue of USD 64.1 million. This was a 3.5% decrease in sales volume from the previous quarter.

- PT Westrong Metal Industry (WMI): WMI increased its production of high-grade nickel matte, selling 12,304 tons of nickel metal in 3Q 2024, a 47.1% increase compared to the previous quarter, and generating revenue of USD 164.7 million. WMI also exported nickel matte to European buyers such as Glencore.

- PT Blue Sparking Energy (BSE): The development of the High Pressure Acid Leach (HPAL) facility has progressed, with the delivery of two autoclaves in October 2024 and one more expected to arrive in November 2024.

- Coal Sales Volume: The coal sales volume for the first nine months of 2024 was 4.8 Mt, which is a 9.2% decrease compared to 5.3 Mt in the same period in 2023.

These operational metrics show PT Harum Energy Tbk’s growing presence in the nickel industry, with increased production volumes and sales.

Strategic Investments and Corporate Restructuring

PT Harum Energy Tbk has undergone significant corporate restructuring to strengthen its position in the nickel industry. These strategic moves include acquisitions, the issuance of mandatory convertible notes, and changes in ownership.

- Mandatory Convertible Notes (MCN): The company issued Mandatory Convertible Notes (MCN) to Ever Rising Limited (ERL), the international arm of Eternal Tsingshan Group (ETG). Upon conversion, ERL will have a 49% stake in the Nickel Portfolio, which includes HNP and THN, while PT Harum Energy Tbk will remain the majority shareholder. The issuance of the MCN improves the capital structure of the nickel business unit by reducing the liabilities-to-equity ratio and supports the long-term growth of the nickel business.

- Acquisition of NICAP: PT Harum Energy Tbk acquired a 51% stake in Nickel International Capital Pte. Ltd. (NICAP), which holds a 49% stake in the laterite mine, PT Position.

- Acquisition of WMI: HNI, a subsidiary of the group, acquired an additional 60.70% of WMI’s shares on January 26, 2024, gaining control of WMI.

- Acquisition of IMI: In September 2023, THN, a subsidiary of the group, increased its ownership of IMI to 99.99% from 49%.

- Capital Expenditure: Total capital expenditure in the first nine months of 2024 was USD 80.6 million, primarily related to the progress of construction in BSE and WMI and acquisitions of mine properties in POS, MSJ, and SB.

- Increased Non-Current Assets: The company’s non-current assets increased by 77.1% to USD 2,038.8 million as of September 30, 2024, mainly due to investments in BSE and WMI.

- Increased Liabilities: Total liabilities increased to USD 934.0 million as of September 30, 2024 from USD 458.4 million as of December 31, 2023.

These strategic moves underscore PT Harum Energy Tbk’s commitment to expanding its nickel business and securing its position in the global nickel supply chain.

Financial Position

PT Harum Energy Tbk’s financial position as of September 30, 2024, shows a company with increased assets, liabilities, and equity.

- Total Assets: The company’s total assets included cash and cash equivalents of USD 205.3 million, and trade receivables of USD 162.2 million. Total non-current assets were USD 2,038.8 million, up from USD 1,200.8 million as of December 31, 2023.

- Total Liabilities: Total liabilities increased to USD 934.0 million, up from USD 458.4 million at the end of 2023. This increase was mainly due to an increase in bank loans, payable to non-controlling interests, and trade payables.

- Equity: The equity attributable to owners of the parent as of September 30, 2024, was USD 1,366.6 million, a 54.3% increase from the end of 2023 due to income generated during the period and the issuance of mandatory convertible notes.

- Current Ratio: The current ratio as of September 30, 2024, was 2.1x.

- Cash and cash equivalents: Cash and cash equivalents totaled USD 205.3 million as of September 30, 2024, compared to USD 157.2 million at the beginning of the period.

The increases in assets, liabilities, and equity reflect the company’s expansion and strategic investments during the period.

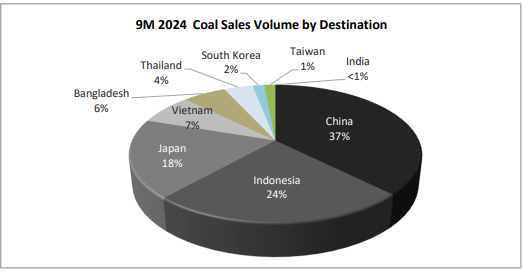

Coal Sales Destinations

The company’s coal sales are primarily directed to the following regions:

- China: 37%

- Indonesia: 24%

- Japan: 18%

- Vietnam: 7%

- Bangladesh: 6%

- Thailand: 4%

- South Korea: 2%

- Taiwan: 1%

- India: <1%

This diversified sales destination strategy reduces the company’s reliance on any single market, ensuring stable demand for its coal products.

Community Engagement

PT Harum Energy Tbk also demonstrates a commitment to community development through various initiatives.

- Education Programs: The company is involved in community development and empowerment programs to promote education in the Kota Maba District. For instance, PT Position (POS) designed an English learning program for elementary schools in the district.

These efforts reflect the company’s corporate social responsibility and its commitment to supporting the communities in which it operates.

Future Outlook

Looking ahead, PT Harum Energy Tbk is poised for continued growth, especially in the nickel sector, as they become an integral part of a globally integrated nickel value chain, which encompasses mining, processing and distribution.

- Nickel Growth: The company’s strategic partnerships, acquisitions, and investments in the nickel business suggest a focus on leveraging the growing demand for nickel, particularly for batteries and energy transition technologies.

- HPAL Facility: The ongoing development of the High Pressure Acid Leach (HPAL) facility at PT Blue Sparking Energy (BSE) is expected to enhance the company’s production capabilities and product offerings.

- Sustainability: The company emphasizes making the nickel supply chain more accessible and sustainable in order to support global energy transition.

- Debt Management: PT Harum Energy Tbk issued mandatory convertible notes to improve its capital structure, reducing its liabilities-to-equity ratio.

PT Harum Energy Tbk’s strategic shift towards nickel, combined with its ongoing operational enhancements, positions it well for future growth in the dynamic global commodity market.

The company’s leadership is focused on maintaining healthy capital ratios and will be looking to maximize shareholder return as well.

Conclusion

PT Harum Energy Tbk has demonstrated a strong financial performance in the first nine months of 2024, characterized by significant revenue growth driven by its nickel business, despite headwinds in the coal sector. The company’s strategic corporate restructuring, including the issuance of mandatory convertible notes, the acquisition of additional stakes in WMI, and its investment in nickel mining, processing and distribution, reflects a forward-looking approach to the evolving energy landscape.

With ongoing projects such as the HPAL facility development, the company is positioned to capitalize on the increasing global demand for nickel, making it a key player in the energy transition. The company has also continued to prioritize its commitment to community development programs. Despite a decrease in profit, the company’s growth and strategic positioning highlight a positive outlook for its future performance.

Frequently Asked Questions about PT Harum Energy Tbk

- What are the primary business activities of PT Harum Energy Tbk? PT Harum Energy Tbk is a holding company that operates and invests in coal and nickel mining, nickel processing, trading, and services through its subsidiaries. The company’s main operations involve the extraction and sale of coal and nickel ore, as well as the processing of nickel into refined products. It also engages in activities related to electricity generation and management consulting.

- Which countries are the main destinations for PT Harum Energy Tbk’s coal sales? The main destinations for PT Harum Energy Tbk’s coal sales, as of 9 months of 2024, are: China (37%), Indonesia (24%), Japan (18%), Vietnam (7%), Bangladesh (6%), Thailand (4%), South Korea (2%), Taiwan (1%) and India (less than 1%). This shows a significant concentration of sales within Asia.

- What changes have occurred in PT Harum Energy Tbk’s corporate structure, particularly related to its nickel business? There have been significant changes in PT Harum Energy Tbk’s nickel portfolio. Upon conversion of the Mandatory Convertible Notes (MCN), the MCN holder will have an effective ownership of 49% in the Nickel Portfolio, consisting a shareholding of 49% in HNP and shareholding of 17.76% in THN. As a result, HNP, HE and MEN would hold 63.75%, 18.32% and 0.17% shares in the equity capital of THN, respectively. Additionally, HE subscribed for 51% shares in NICAP in September 2024. These transactions highlight a significant restructuring and consolidation of the nickel business.

- How does PT Harum Energy Tbk handle its financial instruments and what are its key accounting policies? PT Harum Energy Tbk classifies financial assets into categories such as those measured at amortized cost, those at fair value through other comprehensive income (FVOCI) with accumulated profit and loss recycling, and fair value through profit or loss (FVTPL). The measurement of financial assets depends on their classification and subsequent valuation. The company also uses the effective interest method for debt instruments. For liabilities, financial liabilities are classified as loans and borrowings at amortized cost. The Group applies an expected credit loss model for debt instruments not classified at FVTPL and financial guarantee contracts. The company derecognizes assets when rights to cash flows expire or are transferred and evaluates risks and benefits. Additionally, inventories are valued at the lower of cost and net realizable value.

- What are the primary sources of debt financing for PT Harum Energy Tbk and its subsidiaries? The company utilizes bank loans and debt to non-controlling shareholders. Key creditors include PT Bank UOB Indonesia, PT Bank Mandiri, PT Bank DBS Indonesia, Bank of China Ltd., PT Bank CIMB Niaga Tbk, DBS Bank Ltd, and PT Bank OCBC NISP Tbk, among others. These facilities include both term loans and revolving credit facilities. Additionally, subsidiaries like THN and NICAP have also secured loans from non-controlling shareholders and third parties. The company also utilizes debt in the form of notes payable with varying terms and creditors, like Berg Holding and ERL. These debts are used to support general operations, investments, and working capital.

- What are some of the significant agreements and commitments that PT Harum Energy Tbk has in place? PT Harum Energy Tbk has various agreements in place including: mining and transportation service agreements with contractors such as Thiess Contractors Indonesia (TCI), coal sales agreements with customers, coal handling services agreements (like with PT Tambang Damai), inter-shareholders agreements, and credit facility agreements with a syndicate of banks and its subsidiaries. These include a facility agreement from 2011 which has been amended multiple times, a THN loan facility, and various notes payable agreements with several third parties. The company is also subject to Domestic Market Obligation (DMO) regulations. The company also has reclamation and mine closure guarantees in place, along with forestry fee commitments.