Indonesia’s Nickel Dominance and Price Slump Create Supply Chain Concerns

Global – A new report by the International Energy Agency (IEA), “Global Critical Minerals Outlook 2024,” released May 17, 2024, highlights Indonesia’s growing dominance in the nickel market and the resulting impact on global supply, prices, and environmental concerns. The report details a complex landscape where oversupply, primarily driven by Indonesian production, has caused significant price drops, creating both opportunities and risks for the clean energy transition.

The IEA report reveals that nickel prices fell by more than 40% in 2023, primarily due to a surge in output from Indonesia. This oversupply, combined with a downstream inventory overhang and slower demand from the stainless steel industry, has led to a significant market correction. While nickel demand grew by 4% in 2022 and 8% in 2023, mined nickel supply increased by 19% in 2022 and 9% in 2023, with Indonesia’s production growth exceeding global output growth in 2023.

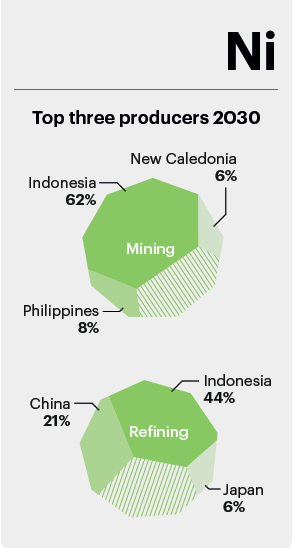

According to the report, Indonesia’s share of global nickel supply has risen dramatically, from 34% in 2020 to 52% in 2023 for mined output, and from 23% to 37% for refined output. This increase is largely due to the country’s successful implementation of high-pressure acid leaching (HPAL) projects, which convert laterite ores into high-purity nickel products. Indonesia’s HPAL projects yielded 180 kilotonnes (kt) of nickel in 2023, a significant rise from 88 kt in 2022. Additionally, the development of a process to convert nickel pig iron (NPI) to nickel matte has further boosted the country’s output.

“The remarkable increase in nickel supply from Indonesia is a notable example” of how new projects have added to the supply pool. However, this growth has come with challenges. The oversupply of Class II nickel and intermediates from Indonesia and China, along with mechanisms to bring these products to the Class I market, coincided with weak demand, leading to a sharp correction in prices.

These low prices have had a detrimental impact on higher-cost producers, with some temporarily suspending production or even ceasing operations. For example, Panoramic Resources halted operations at its Savannah nickel mine in West Australia, and BHP is reassessing its Nickel West operations in Australia. According to the IEA, around 25 operating or potential mines could be at risk if low prices persist, primarily located in Canada and New Caledonia. The report notes that this could lead to a supply loss of approximately 360 kt of supply in 2030 and 280 kt in 2040.

Despite the challenges, Indonesia’s role in shaping the global nickel market is set to continue expanding. The report projects that in the base case, Indonesia’s mined nickel supply will reach 3.278 million tonnes (Mt) by 2040, up from 1.787 Mt in 2023. Additionally, refined nickel production in Indonesia is projected to increase to 2.365 Mt by 2040, compared to 1.414 Mt in 2023. This means the country would continue to maintain a dominant market share in refined nickel production, growing from 45% in 2023 to 59% in 2040.

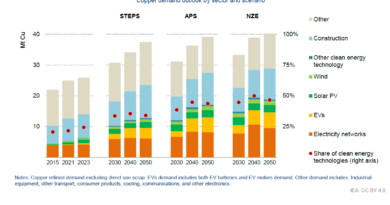

The IEA highlights the critical role of nickel in the clean energy transition, particularly in EV batteries. The report states that in the Net Zero Emissions by 2050 (NZE) scenario, nickel demand for EV batteries increases ninefold between now and 2050. While Indonesia’s nickel supply is crucial to meet this demand, the report also raises concerns about the environmental impact of its production processes. The primary nickel production route in Indonesia is rotary kiln electric furnace (RKEF), which accounts for nearly 90% of production and results in high CO2 emissions. The IEA notes that absolute CO2 emissions from nickel refining in Indonesia could be 1.4 times higher in 2030 and 1.6 times higher in 2040, compared to 2023 if the country does not shift its power and thermal energy sources away from coal.

The IEA emphasizes that while a transition to less energy-intensive processes such as HPAL could reduce the CO2 intensity per tonne of refined nickel, absolute emissions are likely to increase without a shift to cleaner energy sources. Additionally, the shallow, open-pit mining methods used in Indonesian nickel production have led to significant deforestation and the clearing of farmland, with a land footprint of 42 square meters per tonne of nickel contained in ore.

To address these issues, the report calls for policy measures to support a price premium for low-emissions nickel, as well as regulatory interventions to incentivize the production and consumption of responsibly sourced materials. According to the IEA, “Subsidies or tax credits could be used to support the production of responsibly sourced nickel”. The report also notes that some market participants are exploring ways to incentivize responsible sourcing. For example, “the First Movers Coalition aims to leverage the collective purchasing power of major market participants to create early markets for low-emissions steel, aluminium, cement”.

The IEA concludes that while the recent low-price environment for nickel supports the growth of the EV market by keeping battery prices low, it also poses risks to the long-term viability of nickel supplies and the prospects for greater diversification. The report stresses the importance of a multifaceted approach that not only addresses supply and demand gaps but also prioritizes environmental sustainability and responsible sourcing practices.

The IEA’s analysis is based on data from various sources, including company financial reports, S&P Global, and Wood Mackenzie. The report stresses that the findings highlight the need for greater market transparency, including public data, to enable informed investment decisions, supply risk identification, and improved ESG performance tracking.