Indonesia Considers Significant Nickel Royalty Hike, Impacting Miners

Sydney, Australia – The Indonesian government has announced a public consultation period for potential increases to mining royalties, including a significant rise for nickel ore, Nickel Industries Limited (ASX: NIC) revealed in a statement released on March 12, 2025.

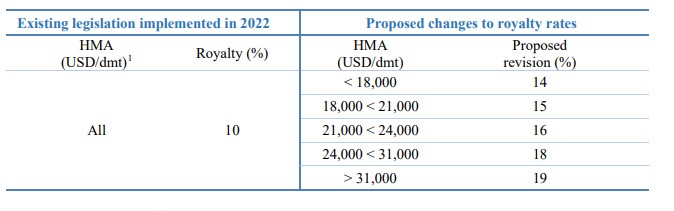

The proposed changes could see royalties on nickel ore sales jump from the current 10% to between 14% and 19%, depending on prevailing nickel prices.

The consultation, disclosed by Nickel Industries, signals a potential shift in Indonesia’s mining tax regime. The company, which is currently subject to a 10% royalty on both saprolite and limonite nickel ore sales, highlighted the possible financial implications based on its 2024 revenue.

Using the PT Hengjaya Mineralindo (Hengjaya Mine) sales revenue of US$205 million from the previous year, Nickel Industries estimates that if the proposed royalty changes were enacted, its royalty payments would have increased by approximately US$8 million.

The proposed royalty structure introduces a tiered system where higher nickel prices would trigger higher royalty rates. Specifically, for nickel ore with a Harga Mineral Logam Acuan (HMA) – the average London Metal Exchange (LME) nickel price over the past month – below US$18,000 per dry metric tonne (dmt), the royalty would be 14%. This rate would incrementally increase, reaching 19% for prices exceeding US$31,000 per dmt. The company noted that while the royalty rates could increase with higher nickel prices, its profit margins could also be expected to improve under such conditions.

Nickel Industries clarified that the proposed royalty changes would only impact its nickel ore sales, primarily from the Hengjaya Mine. Royalties on other nickel products, such as nickel pig iron (NPI), are only applicable to mining operations with integrated processing facilities that do not involve external ore sales.

As Nickel Industries’ RKEF (rotary kiln electric furnace) entities purchase all their nickel ore externally, they are not subject to these royalties. Furthermore, the company anticipates that its upcoming Excelsior Nickel Cobalt HPAL (ENC) project, expected to be commissioned in the second half of 2025, will produce higher-margin refined products like mixed hydroxide precipitate (MHP), nickel sulfate, and nickel cathode, which are currently not subject to royalties and are not included in the current public consultation proposal.

Nickel Industries emphasized that the public consultation period is typically between three to six months, and there is no guarantee that the proposed royalties will be implemented.

The company, an ASX-listed entity with significant mining and processing assets in Indonesia, including a controlling interest in the Hengjaya Mine and four RKEF projects, is also expanding its focus into the electric vehicle battery supply chain.

This includes its 10% stake in the Huayue Nickel Cobalt (HNC) HPAL project. Nickel Industries stated it will provide further updates on the royalty situation as required.