New Regulation PP 19/2025 introduces tiered royalty tariffs for coal and nickel

Jakarta, – The Indonesian government has officially issued Government Regulation Number 19 of 2025 concerning Types and Tariffs for Non-Tax State Revenue (PNBP) applicable to the Ministry of Energy and Mineral Resources and Mineral and Coal Resources. The regulation, signed and promulgated on April 11, 2025, outlines new tariffs for various non-tax revenues within the energy and mineral resources sector and will take effect 15 working days from its promulgation.

This new regulation aims to revise and update the existing types and tariffs of Non-Tax State Revenue in the energy and mineral resources sector. It was enacted to implement stipulations within existing laws and regulations concerning state revenue and non-tax state revenue management applicable within the purview of the Ministry of Energy and Mineral Resources.

Government Regulation Number 19 of 2025 specifies various categories of Non-Tax State Revenue. These include revenues from the utilization of natural resources, public services, the utilization of state assets, administrative fines, and other revenues related to the energy and mineral resources sector. The specific tariffs for these various revenue types are detailed within the appendices of the regulation. For instance, the regulation specifies tariffs related to the granting of Mining Business Permits (IUP) and Special Mining Business Permits (IUPK) at various stages, such as exploration and production operations. It also outlines tariffs for the sale of mining products/royalties based on the type of mineral and prevailing market prices, as indicated in the attached tariff schedule which includes details for nickel.

The regulation also covers administrative services provided by the Ministry, such as the issuance of licenses, certifications, and technical services. Additionally, it addresses financial obligations at the end of work contracts, potentially including penalties for unmet commitments.

Government Regulation Number 19 of 2025 supersedes or revises previous regulations concerning Non-Tax State Revenue within the Ministry of Energy and Mineral Resources. This update reflects the government’s ongoing efforts to optimize state revenue from the natural resources sector and ensure regulatory clarity. The detailed tariffs and types of PNBP outlined in this regulation will serve as the basis for revenue collection within the energy and mineral resources sector moving forward.

Royalty Tariffs for Coal

The regulation specifies royalty tariffs for coal based on its calorific value (kcal/kg) and free-on-board (FOB) price.

- For open-pit coal with a calorific value ≤ 4,200 Kcal/Kg (Gross Air Received), the tariff ranges from 5% to 9% of the price depending on the FOB price (≤ USD70, > USD70 to < USD90, and ≥ USD90).

- For open-pit coal with a calorific value > 4,200 – 5,200 Kcal/Kg (Gross Air Received), the tariff ranges from 7% to 11.5% of the price based on the FOB price thresholds.

- For open-pit coal with a calorific value > 5,200 Kcal/Kg (Gross Air Received), the tariff ranges from 9.5% to 13.5% of the price according to the FOB price.

- Underground coal has a royalty tariff of 1% of the price.

- Coal in the form of Briquettes, Pellets, and Char Coal also have specified royalty tariffs. For instance, coal briquettes have a tariff of 10% of the price.

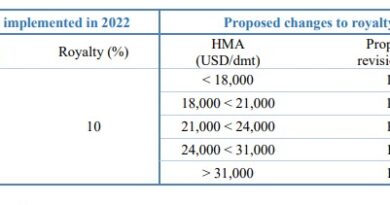

Royalty Tariffs for Nickel

The regulation outlines royalty tariffs for various forms of nickel.

- For Nickel Ore, the tariff ranges from 14% to 19% of the price per ton depending on the nickel content (HMA) and price per ton (≤ USD18,000 to ≥ USD31,000). There is also a specific tariff for Nickel Ore Kadar Ni ≤ 1.5% as raw material for the laterite nickel smelting industry at 2% of the price per ton.

- For Nickel Pig Iron (NPI), the tariff ranges from 5% to 7% of the price per ton based on the HMA and price thresholds.

- For Nickel Matte, the tariff ranges from 3.5% to 5.5% of the price per ton depending on the HMA and price.

- For Ferro Nickel (FeNi), the tariff ranges from 4% to 5% of the price per ton based on the HMA and price.

- Other nickel products like Nickel Oxide/Nickel Hydroxide/Nickel MHC/Nickel Sulfat/Kobalt Sulfat/Krom Oksida/Logam Krom/Mangan Oksida/Magnesium Oksida/Magnesium Sulfat/Logam Nickel have a royalty tariff of 2% of the price per ton.

- While for pure nickel metal (Logam Nikel) itself has a tariff of 1.5% of the price per ton.

Frequently Asked Questions: Indonesian Regulation on Non-Tax State Revenue from Energy and Mineral Resources

- What is the purpose of this regulation (Peraturan Pemerintah Nomor 19 Tahun 2025)?

This regulation aims to govern the types and tariffs of non-tax state revenue (PNBP) originating from the energy and mineral resources sector. It is intended to optimize state revenue, strengthen fiscal resilience, support national development, improve public welfare, and create investment certainty in this crucial sector.

- What are the primary categories of Non-Tax State Revenue (PNBP) covered by this regulation?

The PNBP covered includes revenue from the exploitation of natural resources (like oil, gas, and various minerals), management of state property in the energy and mineral sector, services provided by the relevant ministries/agencies (such as licensing and training), administrative fines, and other revenues related to energy and mineral resources activities. The specific types and tariffs are detailed in the regulation’s appendices.

- How are the tariffs for PNBP determined under this regulation?

The tariffs are determined based on various factors, including the type of resource, production volume, calorific value (for coal), reference prices, exchange rates, and the stage of activity (exploration, exploitation, processing, refining). The regulation provides specific formulas and tables outlining these tariffs, often as a fixed amount per unit or a percentage of the sales value or market price.

- What are some examples of specific PNBP charges outlined in the regulation?

The regulation details numerous specific charges, including fees for exploration and exploitation permits, royalties on produced minerals and coal (with varying percentages based on calorific value and price), surface rentals for mining areas, fees for various types of inspections and certifications, administrative sanctions for violations, and service fees for training and geological surveys.

- Are there any financial obligations related to the end of a work contract or mining permit?

Yes, the regulation addresses financial obligations at the end of a work contract or mining permit. These obligations can take the form of penalties if certain operational or investment commitments were not fulfilled during the contract period. The specific penalties and their calculation methods are outlined in the regulation.

- Does this regulation address environmental obligations or guarantees?

While the primary focus is on revenue, the regulation does mention guarantees related to reclamation and post-mining activities. It also includes provisions for environmental monitoring and analysis, the costs of which are likely to be borne by the permit holders and contribute to state revenue through related fees or administrative sanctions for non-compliance with environmental regulations.

- What kind of administrative sanctions or penalties are mentioned in the regulation?

The regulation mentions administrative fines or penalties for various non-compliance issues, such as failure to meet financial obligations, delays in payments, or potentially for not adhering to operational regulations. These penalties contribute to the non-tax state revenue.

- When does this regulation come into effect?

Based on the document, Peraturan Pemerintah Nomor 19 Tahun 2025 was enacted and stipulated in Jakarta on April 11, 2025. Article 11 states that this regulation comes into effect 15 (fifteen) days after its promulgation.