Capital Concerns Top Mining Sector Risks as Companies Balance Growth and Discipline

Global Mining Industry – Capital has emerged as the number one risk for mining and metals companies in 2025, according to a recent EY report, highlighting the ongoing tension between the need for growth and the demand for capital discipline and returns. The report, based on a survey of 353 senior mining and metals leaders globally, indicates that miners are facing increased scrutiny from investors on how investment is deployed, with a strong focus on capital management. This is occurring at a time when the industry is also facing the need to invest heavily to meet the surging demand for energy transition minerals.

The report indicates that while mining companies are focused on capital discipline, unlocking growth requires a shift in focus. Miners need to think beyond short term yields and consider using excess capital to invest in future value.

- Increased Scrutiny: Investors are increasingly focused on capital discipline and returns through dividends and share buybacks, driving greater scrutiny of how investment capital is deployed.

- Transaction Activity: Mining companies are accelerating growth and amplifying value through mergers and acquisitions (M&A), as well as spinning off non-core or high-growth assets. In a recent EY CEO Outlook Pulse Survey, all mining and metals respondents said they plan to undertake some form of transaction over the next 12 months.

- Diversified Financing: Companies are expanding their financing options and considering an average of four sources of capital, including commodity traders, supplier funding, export credit finance, and traditional debt and equity.

The report said that miners continue to face increased scrutiny from investors on how investment is deployed, with a strong focus on capital discipline and returns.

The challenging macroeconomic conditions are pushing mining companies to consider partnerships, joint ventures (JVs), or integration to mitigate risk on large-scale projects. However, the report suggests that enabling the necessary investment could require more fundamental changes to the sector’s approach to financing, going beyond yield and investing capital to create long-term value.

“Tough financing and macroeconomic conditions are making it more difficult for miners to raise capital despite the growing need for critical minerals,” the report notes.

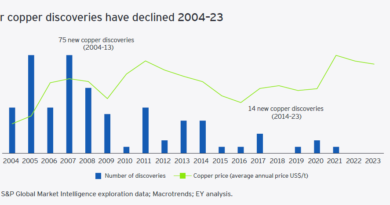

The report also highlights that market valuations are diverging, with high-growth stocks focused on critical minerals for the energy transition being rewarded with stronger multiples. This is forcing management to assess portfolios and consider structural changes, with M&A at the forefront. The report mentions that mergers in the past few years have largely been in gold, as companies scale operations and secure strategic assets. With a robust outlook for copper demand, more consolidation of copper assets by the majors is expected.

The report indicates that battery mineral producers are rethinking capital allocation due to the drop in lithium, cobalt and nickel prices, with some companies like Albemarle reducing investments. This could tighten the battery mineral market in the long term as demand increases. Some companies may also delay major investment decisions due to uncertainty related to elections, which could impact the flow of capital into the mining sector in the US.

Historically, mining companies have been viewed as yield plays and have not been able to access the same level of capital. The report suggests that this approach to financing will need to change for companies seeking to bring greater supply online for the energy transition. Companies are now accessing a wider range of capital and considering alternative sources of finance and partnerships to help share the financial burden and mitigate risks of large-scale projects.

Technically, the report emphasizes that mining companies must evolve their capital strategies to navigate long-term market shifts, including re-focusing core business areas and prioritizing initiatives that align with strategic objectives. Additionally, it stresses the importance of investing in managing sustainability risk, recognizing that such investments, while not always showing short term returns, have the potential to deliver value in the longer term.