Copper Supply Gap Looms Amidst Rising Clean Energy Demand, IEA Warns

Global – A new report by the International Energy Agency (IEA), “Global Critical Minerals Outlook 2024,” released May 17, 2024, warns of a potential major copper supply shortfall emerging as demand for clean energy technologies surges. The report highlights the critical role of copper in the energy transition and the challenges in meeting future demand given declining ore quality, lack of new large-scale projects and geopolitical risks.

The IEA report indicates that copper demand is projected to grow rapidly in all scenarios, driven by the deployment of renewable energy sources like solar PV and wind, electric vehicles (EVs), and electricity networks. Copper is essential in all of these technologies because of its unique combination of electrical conductivity, durability, ductility, and resistance to corrosion. Demand is expected to grow from 26 Mt in 2023 to 30 Mt by 2030, and as high as 40 Mt by 2050. The report notes that clean energy technologies alone are expected to drive copper demand from 6.311 Mt in 2023 to 12.001 Mt in 2030 and 16.343 Mt by 2040 in the Announced Pledges Scenario (APS).

However, the report indicates that current copper supply is not on track to meet this demand. Mined copper supply is projected to reach around 25 Mt in 2026 and then decline as assets age and ore grades decrease. This is further compounded by the fact that there is a lack of large-scale projects in the pipeline, creating challenges for future copper supply. Even under a high production scenario, the projected supply by 2035 falls short of the APS requirements. According to the IEA, a copper primary supply shortfall may develop after 2025 in all three scenarios (Stated Policies Scenario (STEPS), APS, and Net Zero Emissions by 2050 (NZE) Scenario).

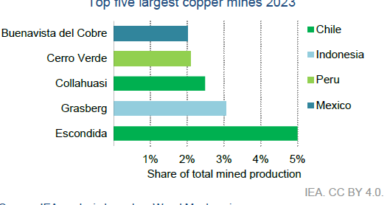

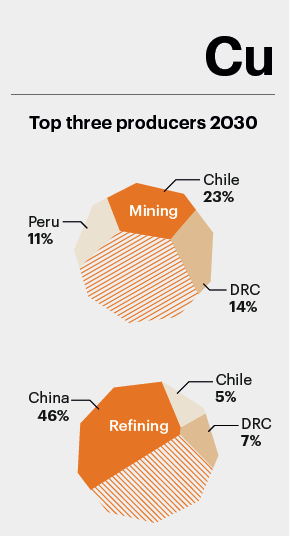

The report notes that Chile is the world’s largest copper miner, producing a quarter of global supply in 2023. However, its share has decreased since 2015 due to declining ore grades and aging assets. The Democratic Republic of Congo (DRC) has doubled its share of global supply since 2015 to 12% in 2023, overtaking Peru as the second-largest supplier, largely due to the high-grade copper resources found in the DRC. China is the world’s dominant copper refiner with 45% market share in 2023, having grown from 30% in 2015. While Chile is a major copper miner, it only refines about 8% of global refined copper.

According to the report, “Based on the current project pipeline, mined copper supply reaches around 25 Mt in 2026 then declines thereafter as assets age and grades decline.” The top three producer’s share in total mine production increases to 55% by 2040 from 47% in 2023, with Chile, the DRC, and China leading production. The report notes that this presents a major dependency and vulnerability.

The report also emphasizes the growing importance of secondary copper supply. Currently, secondary supply accounts for 17% of total demand, but in the NZE scenario, this is expected to increase to 30% by 2040. The IEA stresses that copper is highly recyclable without any loss of quality, but improvements are needed in collection infrastructure, sorting technologies, and policy mandates to boost recycling efforts. According to the IEA, “Recycling is one of the most crucial measures to reduce primary copper supply pressure going forward”.

Key challenges highlighted in the report include:

- Declining Ore Quality: The average grade of copper concentrate in Chile has decreased 30% since 2005.

- Rising Costs: Operating and capital costs for copper projects have increased, making it more expensive to expand existing mines or develop new ones.

- Social and Environmental Opposition: Growing community protests and environmental concerns are disrupting production in some regions, particularly in Latin America. For example, the Cobre Panama mine, one of the world’s largest, was shut down due to environmental and corruption concerns.

- Geographical Concentration: The report notes that copper refining is highly concentrated in China.

The IEA emphasizes the need for a broad range of measures to address the looming supply gap. These measures include increased investment in new mining projects, greater utilization of scrap metal, and policies promoting recycling and material efficiency.

According to the report, “Even in the high production case, supply would have to increase by 60% in the APS and 75% in the NZE Scenario by 2040 to meet demand.”. The IEA also recommends that governments and international mining companies should work closely with local communities to ensure that benefits are shared equitably. Additionally, they suggest supporting novel technologies for extracting copper from lower-grade ores, and improving recycling.

The IEA’s analysis is based on data from S&P Global, Wood Mackenzie, and company financial reports. The report concludes that while there is a critical need for increased copper production, this must be done in a sustainable and responsible manner that prioritizes environmental protection, community engagement and fair labor standards. The IEA notes that “The lack of diversification going forward, particularly in refining is also a key risk for the security of supply of copper”.

Historically, copper prices have been less volatile compared to other commodities; however, price spikes could have a significant impact on grid deployment, which accounts for 20% of capital costs. The report stresses that the security of supply of copper is paramount for the energy transition. The report also points out that Chile’s copper concentrate exports to China have increased by 60% since 2012, while refined copper exports have dropped 20% over the same period.