Critical Mineral Price Drops Present Double-Edged Sword for Clean Energy Transition

Global – A recent report by the International Energy Agency (IEA), “Global Critical Minerals Outlook 2024,” highlights a complex situation in the critical minerals market, where sharp price declines in 2023, following a period of dramatic increases, present both opportunities and challenges for the clean energy transition. The report, published on May 17, 2024, offers new medium- and long-term outlooks for the supply and demand of key minerals essential for clean energy technologies.

The IEA report reveals that prices for critical minerals, particularly those used in batteries, plummeted in 2023. Lithium spot prices saw the most significant drop, decreasing by 75%, while cobalt, nickel, and graphite prices fell by 30-45%. The IEA Energy Transition Mineral Price Index, which tracks the price of a basket of copper, major battery metals, and rare earth elements, had tripled in the two years following January 2020 but relinquished most of those gains by the end of 2023. These declines were mainly driven by a strong increase in supply and ample inventories, which outpaced demand growth. According to the report, the ramp-up of new supply from regions including Africa, Indonesia, and China, contributed to this.

The price drops have resulted in a 14% decrease in battery prices in 2023. However, these lower prices present a challenge for new investments in diversified supply chains, as investors become less interested in spending to ensure reliable and diversified supply. According to the IEA, about USD 800 billion of investment in mining is required to meet the 1.5 °C scenario by 2040, and these investments need to foster a more diversified array of supply sources. The report also notes that the market size for key energy transition minerals contracted by 10% to USD 325 billion in 2023 due to these price declines.

“Today’s price declines are a double-edged sword – a boon for clean energy deployment but a bane for critical mineral investment and diversification,” the IEA report states. This situation makes it more challenging for new and emerging resource holders, as three-quarters of operating or potential nickel projects at risk are outside the top three producers. The report emphasizes the need for specific policy measures to reinforce the investment case for supply chain diversification, enhanced market transparency, and reliable data on consumption, supply, and trade.

Despite the price declines, clean energy deployment continues to grow, with electric car sales nearing 14 million in 2023, a 35% year-on-year increase. In a scenario limiting global warming to 1.5 °C, the sales share of electric cars is projected to rise from 18% today to 65% in 2030, increasing demand for batteries sevenfold to 6 TWh in 2030. However, the report warns that today’s well-supplied market may not be a good guide for the future, with demand for critical minerals set to more than double to $770 billion by 2040 in a pathway to net zero emissions by mid-century.

The IEA report also highlights the importance of Environmental, Social, and Governance (ESG) considerations, noting mixed progress in the industry. While progress has been made in worker safety, gender balance, and community investment, issues such as waste generation, emissions, and water consumption still need improvement. Voluntary sustainability standards can help improve ESG performance, but greater transparency, due diligence, and harmonized approaches are needed. The industry is making progress on ESG reporting, but there is a need for more consistent and detailed reporting practices.

The report also offers some specific insights for several critical minerals.

- Copper: A primary supply shortfall may develop after 2025, even with a significant growth in secondary supply. The report also notes that the world’s largest copper mines are in Latin America, making the supply chain vulnerable to social and environmental opposition.

- Lithium: Lithium prices fell by over 75% in 2023, leading to production cuts. The report highlights significant regional disparities in the capital costs for developing new projects, with European and American lithium projects generally requiring higher upfront costs.

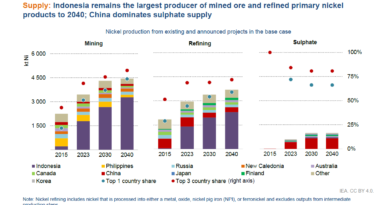

- Nickel: Nickel prices fell more than 40% in 2023, mainly due to oversupply from Indonesia. The report also notes that Indonesia’s nickel processing is associated with high carbon emissions, requiring a shift to lower emissions processes.

- Graphite: Diversification of graphite supply is urgently needed.

- Rare Earth Elements: Concerns about transparent reporting in rare earth markets and the suspension of rare earth mining in Myanmar have been noted.

- Manganese: Manganese demand is expected to increase rapidly due to its use in EV batteries.

The IEA emphasizes the need for a comprehensive approach that includes increased investment in diversified supply, recycling, innovation, and behavioral changes to address the challenges and secure a sustainable supply of critical minerals for the clean energy transition. Market transparency is also crucial, with better pricing mechanisms and reliable data on supply and demand.

The IEA’s analysis draws on a wide range of data sources, including S&P Global Market Intelligence, Wood Mackenzie, and Benchmark Mineral Intelligence. The report stresses that the findings do not mean energy transition goals are unattainable due to material constraints but require further measures to close identified gaps between supply and demand.