Indonesia Emerges as Key Cobalt Producer, Challenging DRC Dominance

Indonesia’s cobalt production is rapidly expanding, solidifying its position as the second-largest global supplier, according to a recent report by Benchmark Mineral Intelligence.

The country’s growing output, driven by its nickel-cobalt operations, is poised to make it a major competitor to the Democratic Republic of Congo (DRC), which currently leads global cobalt production. This shift in the cobalt market was highlighted in the Cobalt Institute’s Q4 2024 Market Report.

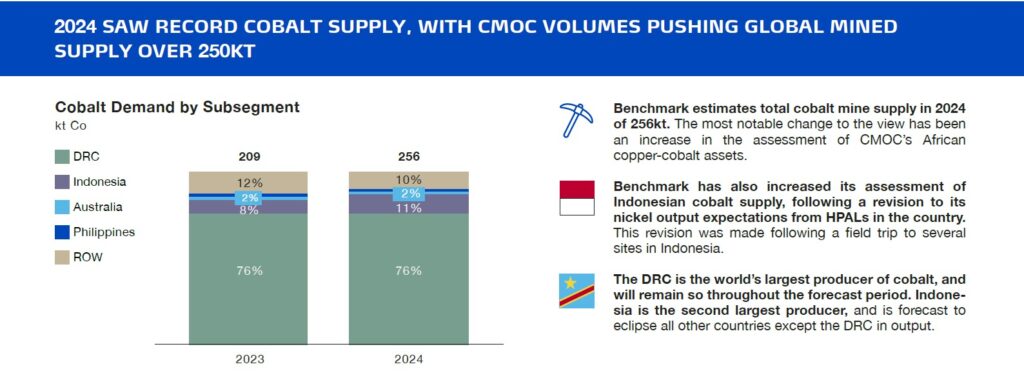

The report indicates that Indonesia’s increased cobalt supply is linked to a revision in nickel output expectations from High-Pressure Acid Leaching (HPAL) plants. This revision followed a field trip to several sites in Indonesia, leading analysts to increase their assessment of the nation’s cobalt production capabilities. While the DRC currently holds 76% of the global cobalt supply, Indonesia is rapidly expanding, potentially eclipsing all other countries except the DRC in cobalt output. The increased supply from Indonesia has contributed to the record-high global cobalt supply of 256kt in 2024.

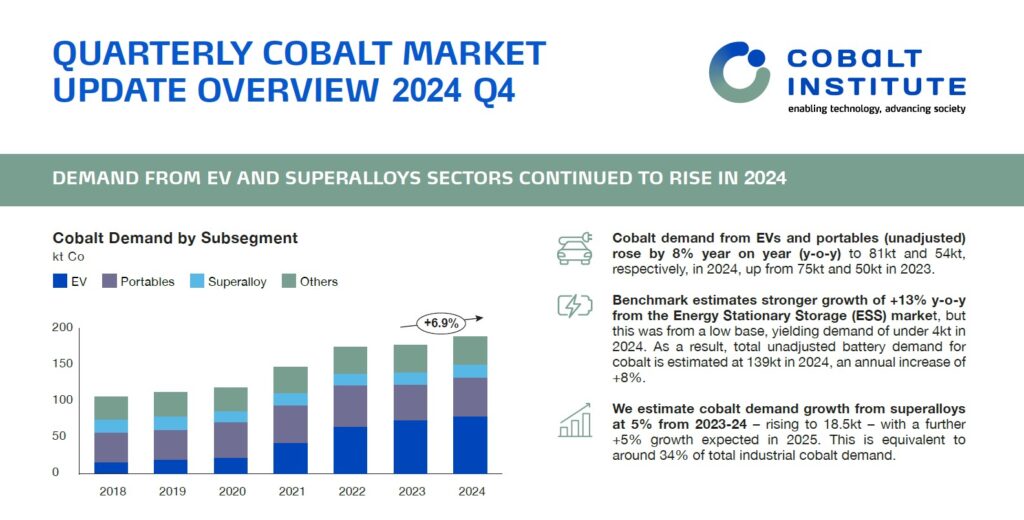

The demand for cobalt has seen significant growth, particularly in the electric vehicle (EV) and portable electronics sectors, which saw an 8% year-on-year increase in 2024. Overall battery demand for cobalt also grew by 8%, reaching an estimated 139kt in 2024. Additionally, the superalloys sector accounts for 34% of industrial cobalt demand, with a 5% growth expected from 2023-24, and a further 5% growth expected in 2025.

According to the report, “Demand growth: EVs and portable electronics drove an 8% year-on-year rise in cobalt demand. Battery demand grew 8% overall, while superalloys saw steady growth, now accounting for 34% of industrial demand”.

The DRC-Zambia Copperbelt is a focal point of geopolitical competition between the US and China, as both countries vie for control over access to critical minerals. Investments in railway infrastructure, such as the US-led Lobito Corridor project and China’s revitalization of the Tanza-nia-Zambia Railway Authority (TAZARA) line, are aimed at securing routes to transport minerals and increase their influence in the region.

The Lobito Corridor project has seen more than $6 billion in investment pledged, while China has pledged around $2 billion to modernize the TAZARA line. The report emphasizes that “

The DRC-Zambia Copperbelt has become a key focus for US-China competition, with major railway investments aiming to secure access to critical minerals”.

Benchmark Mineral Intelligence, which prepared the market analysis, estimates a total cobalt mine supply in 2024 of 256kt. The increase in supply has been significantly influenced by CMOC’s African operations. While the DRC remains the largest producer, Indonesia’s rapid growth in production signals a significant shift in the cobalt market.