Indonesia’s Copper Sector Sees Growth But Remains Minor Player Amidst Nickel Boom, IEA Report Shows

Global – A recent report by the International Energy Agency (IEA), “Global Critical Minerals Outlook 2024,” released May 17, 2024, indicates that while Indonesia’s role in the global copper supply is growing, it remains relatively small compared to other major players. The report highlights that Indonesia’s rapid expansion is primarily focused on nickel production, with copper playing a secondary role.

The IEA report reveals that while Indonesia has seen impressive growth in copper mining, it still accounts for a small fraction of the global supply. In 2023, Indonesia’s share of global mined copper supply reached 5%, doubling since 2020. This growth is partly attributed to the PT Freeport Indonesia (Grasberg) mine, which is one of the top five largest copper mines globally.

The report projects that Indonesia’s share of global copper supply will continue to grow but will level off after 2030, reaching about 7% by 2040. The market value of Indonesia’s mining operations is expected to double by 2030, but this increase is primarily driven by its burgeoning nickel mining activities.

While Indonesia has seen growth in mining, the report indicates that Indonesia is not a major player in global copper refining. The report shows that the market value of refining is expected to be largely concentrated in China, with approximately 50% of the market value by 2030. In 2023, China is the world’s dominant copper refiner with a 45% market share.

The IEA report emphasizes that Indonesia’s rapid growth is mainly focused on nickel production, particularly with the development of high-pressure acid leaching (HPAL) projects. While Indonesia is seeing substantial increases in its nickel output, its impact on the copper market is less significant. The focus on nickel is also driving most of the investment in the Indonesian mining sector, according to the IEA.

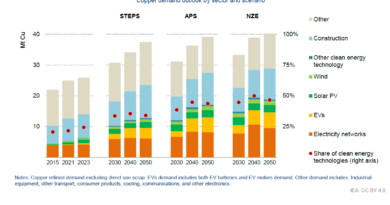

According to the report, “Based on the current project pipeline, mined copper supply reaches around 25 Mt in 2026 then declines thereafter as assets age and grades decline.” However, Indonesia’s copper supply is expected to grow from about 863 kt in 2023 to 948 kt in 2030, leveling off at 861 kt by 2040. This growth, though noteworthy, is less than the rapid increase in Indonesia’s nickel output.

Key takeaways about Indonesia’s copper position include:

- Growing Mining Share: Indonesia’s share of global mined copper supply has doubled since 2020.

- Focus on Nickel: The majority of Indonesia’s mining growth and investment is directed towards nickel.

- Limited Refining Role: Indonesia’s involvement in global copper refining is minimal, with the bulk of refining capacity concentrated in China.

- Grasberg Mine: The PT Freeport Indonesia (Grasberg) mine is one of the world’s largest copper mines.

- Projected Growth: Indonesia’s copper mining market value is expected to double by 2030, but this is overshadowed by its nickel sector’s growth.

The IEA notes that while Indonesia’s copper production is increasing, it does not currently pose a significant challenge to the dominance of countries like Chile and the Democratic Republic of Congo (DRC) in mining, or China in refining. The report notes “Indonesia sees the fastest growth, doubling its market value by 2030 due to its burgeoning nickel mining activities”.

The IEA’s analysis draws on data from S&P Global, Wood Mackenzie, and company reports. The report highlights that the lack of diversification in refining is a key risk for the security of copper supply, but does not note that this risk is related to Indonesia as much as to China. It further underscores that the rapid growth of Indonesia’s nickel sector is creating a different dynamic in the critical minerals landscape, overshadowing its copper sector.

Historically, Indonesia was not a significant player in the global copper market, but its mining sector has seen recent growth. The report indicates that while Indonesia has the potential to play a larger role in the copper market, its current focus on nickel and its limited refining capacity suggest its impact will be less significant than in other areas of critical mineral supply.