Mining Sector Faces Critical Mineral Supply Challenge Amid Energy Transition

Global Mining Industry – The mining and metals sector is facing a significant challenge to meet the soaring demand for critical minerals needed for the energy transition, according to a recent report by EY, a global professional services network. The report, which surveyed 353 senior mining and metals leaders from organizations with at least US$1 billion in revenue during June and July 2024, highlights the urgent need for transformation within the sector to secure the supply of these crucial resources.

The energy transition has created a surge in demand for minerals and metals, and the world has come to realize that the shift to green energy is impossible without a greater supply of these materials. This increased demand is placing immense pressure on mining companies to accelerate growth, all while maintaining capital discipline and meeting higher stakeholder expectations. The report emphasizes that the industry will need to mine more mineral ores in the next 30 years than it has in the last 70,000 years.

“The sector faces a trifecta of challenges: achieving sustainable mining while managing capital discipline and meeting higher stakeholder expectations,” the report states.

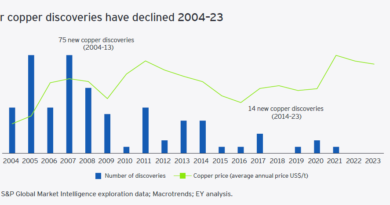

However, the industry faces significant obstacles. Resource and reserve depletion is now a major concern, as rising demand, increasing exploration costs, and a lack of new discoveries make it harder to extract critical minerals. Declining ore grades are also pushing up extraction costs. The report notes that the last two decades have seen few major copper discoveries.

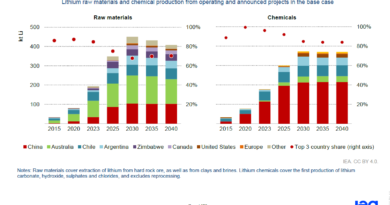

Geopolitical factors further complicate the situation, with resource nationalism on the rise and governments prioritizing self-sufficiency in strategic sectors like mining. The concentration of strategic mineral and metal supplies also creates geopolitical complexity and emphasizes the importance of transparent supply chains.

New projects are essential to meet the growing demand, yet they face numerous hurdles including regulatory issues, high costs and a lack of skilled workers. Long lead times for projects are a challenge, with permitting processes requiring considerable stakeholder negotiation.

To address these challenges, the report suggests a need for significant capital investment, with mining companies urged to consider partnerships and joint ventures to mitigate the risk of large-scale projects. “Miners will need to think beyond yield, using excess capital to invest in future value,” the report notes. There’s also a need for innovation in exploration, extraction, and processing, with investments in technologies like AI and machine learning to improve productivity.

Recycling will also play a vital role, with companies exploring the integration of recycling into their operations to create a circular economy, including better use of scrap and the establishment of collection networks.

“Mining companies are reassessing business models to capture more value, with many focusing on the opportunities presented by sustainability,” the report explains.

Specific minerals mentioned in the report include copper, lithium, and nickel, all of which are vital for the energy transition. The report predicts that the world will need at least 41 million tonnes of copper per year by 2050.

Government intervention is also seen as important, with governments taking a more strategic role in securing the supply of critical minerals through funding and incentives.

The report concludes that a significant transformation of the mining sector is now critical, requiring innovation, collaboration, and agility.

Historically, mining has been a cornerstone of industrial development, and the industry is now at a pivotal moment as it strives to meet the demands of a rapidly changing energy landscape. Technical details in the report reveal that major copper discoveries have been declining since 2007, and that the average lead time for mines starting operations in 2020-23 is 18 years.