Nickel Industries Reports Strong Earnings, Expands Sampala Project

Nickel Industries Limited (ASX:NIC) announced robust operating earnings of US$72.4 million for the December quarter and provided an update on its Sampala Project, including the commencement of mine development and main haul road construction. This news comes as the company continues to expand its mining and processing operations in Indonesia.

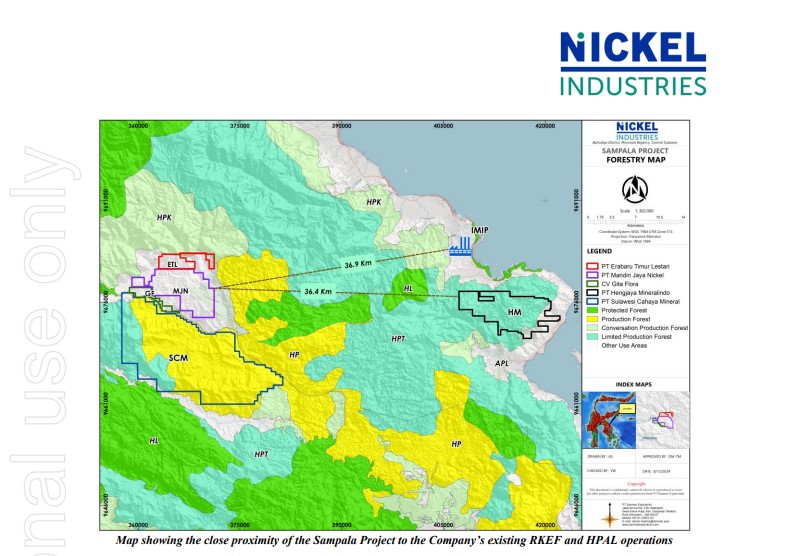

The Sampala Project, consisting of three contiguous nickel-cobalt projects covering 6,654 hectares, has defined an Exploration Target of between 350 and 700 million dry metric tonnes (dmt) at 0.9% to 1.1% nickel, in addition to the existing 187 million dmt resource base. The project, located near the company’s existing rotary kiln electric furnace (RKEF) and high-pressure acid leach (HPAL) operations within the Indonesia Morowali Industrial Park (IMIP), is aimed at making the company self-sufficient in nickel ore supply for its downstream operations.

According to Managing Director Justin Werner, “The consistent, long, high-grade saprolite and limonite intercepts build on the existing JORC Resource of 187 million dmt at 1.2% nickel for 2.3 million tonnes of contained nickel metal, within just 900ha of a 4,700ha mapped prospective laterite area”.

The 2024 drilling campaign, which saw over 45,000 meters drilled across an additional 1,600ha, has returned exceptional grades of up to 7.41% nickel and 1.37% cobalt.

The company believes that the Sampala Project has the potential to become one of the largest nickel deposits globally, positioning Nickel Industries as one of world’s largest holders of contained nickel metal.

Mine development and main haul road construction at Sampala have begun, with an initial production target of 6 million wet metric tonnes (wmt) per annum, ramping up to 20 million wmt per annum.

The company expects a low capital development cost of approximately US$50 million and anticipates the project will become a significant future contributor to earnings. Earthworks for the first 8 km of the main haul road, which will connect to an existing 27km haul road into the IMIP, are scheduled for the first half of 2025.

The Sampala Project acquisition price is linked to the JORC Resource of 1.7% nickel grade (or above). Because the Exploration Target nickel grade is ranging from 0.9% to 1.1%, a significant portion of the contained metal in the deposit will effectively be acquired for “nil” consideration. The company is focused on bringing the Sampala Project into production as swiftly as possible to ensure a secure, long-term, high-quality ore supply for its processing operations at the IMIP. The project’s development also includes the construction of a bridge, camp facilities, offices, and workshops.

Nickel Industries has a long history in Indonesia, with controlling interests in the Hengjaya Mine, as well as four rotary kiln electric furnace (RKEF) projects. The company is transitioning its production to focus on the EV battery supply chain, including a 10% interest in the Huayue Nickel Cobalt (HNC) HPAL project. It is also investing in the Excelsior Nickel Cobalt (ENC) project, which is expected to produce 72,000 tonnes of nickel metal per annum, diversifying the company’s production and reducing its carbon emissions profile.

The 2024 drill program and geological mapping suggests 3,110ha of potential laterite areas, with the drill program expected to take 12 months. The Production Target is based on an existing Mineral Resource of 187 million dmt, comprising of 55 million dmt Indicated and 132 million dmt Inferred Resources and assumes 10 years of production. The project also assumes the Sampala Project is granted the necessary government approvals and that sufficient demand will exist at the IMIP.