Top 10 Mining and Metal Risks in 2025: Navigating a Shifting Landscape

The mining and metals industry is undergoing a significant transformation driven by the global energy transition and increasing demand for critical minerals. To succeed in this dynamic environment, mining companies must proactively address emerging risks and capitalize on new opportunities.

A recent report by EY identifies the top 10 risks facing the mining and metals sector in 2025, highlighting the critical need for innovation, collaboration, and strategic agility.

This article explores these risks, providing insights into how mining companies can navigate these challenges.

1. Capital: Balancing Growth and Discipline

Securing and managing capital remains the number one risk for mining and metals companies in 2025. Investors are increasingly scrutinizing how investment capital is deployed, with a strong focus on capital discipline and returns. Companies are seeking growth through mergers and acquisitions (M&A), spinning off non-core or high-growth assets.

This trend is expected to accelerate as companies balance portfolios to contribute to growth and attract investment.

Mining companies are also exploring multiple financing options, including commodity traders, supplier funding, export credit finance, and traditional debt and equity.

In order to meet the demand for critical minerals, miners must think beyond short-term yields and invest in strategies that build long-term value.

2. Environmental Stewardship: Prioritizing Nature and Sustainability

Environmental stewardship has become a key focus for mining companies. The emphasis is shifting towards creating a positive environmental legacy, with a particular focus on waste and water management. The push for nature-positive initiatives is gaining momentum, driven by organizations like the International Council on Mining and Metals (ICMM).

Almost half of mining companies surveyed are confident they can meet their nature-positive obligations by 2030, which involves halting and reversing nature loss. Progressive miners are capturing value from waste through improved mining practices, implementing closed-loop systems, and reprocessing tailings. Water stewardship is another key area, with companies investing in innovative projects to better manage this resource.

3. Geopolitics: Navigating Resource Nationalism and Global Uncertainty

Geopolitical risks are on the rise, impacting tax rules, ownership rights, and supply chains. Resource nationalism continues to grow, with governments balancing national revenue goals and the need for long-term investments. Mining companies are being encouraged to consider joint ventures with local companies and licensing to derisk investments.

Governments are also prioritizing self-sufficiency in strategic sectors such as mining to bolster national security. The world’s supply of strategic minerals is highly concentrated, creating geopolitical complexity and emphasizing the importance of transparent supply chains. Companies are also building supply chain resiliency by mapping and stress testing supply chains and using AI for demand planning and procurement.

4. Resource and Reserve Depletion: Addressing Declining Ore Grades

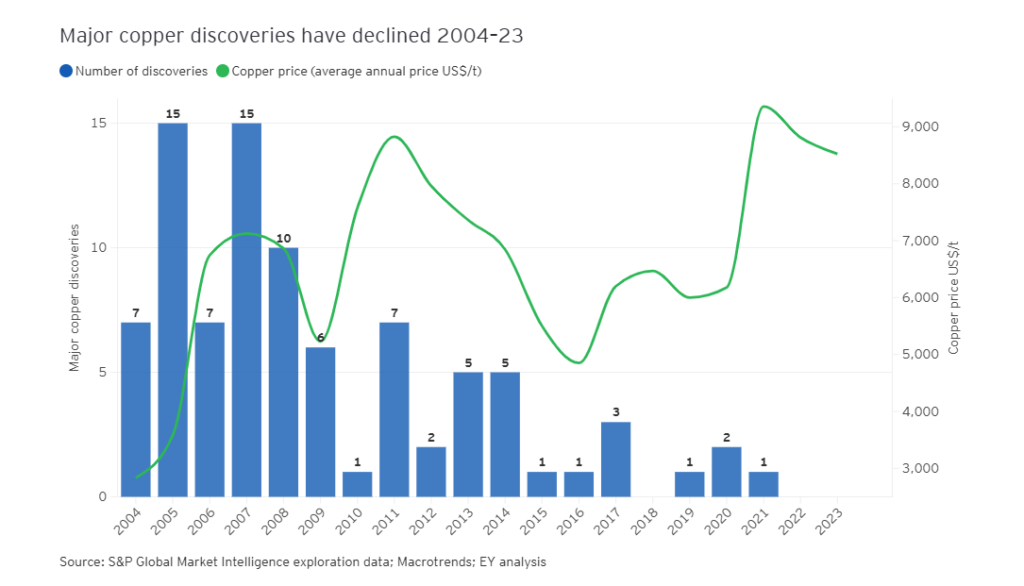

Resource and reserve depletion is a new entry in the top 10 risks, driven by declining ore grades, increasing exploration costs, and a lack of new discoveries. High-grade resources are nearing exhaustion, and accessing metals from new projects with lower ore grades requires more investment and energy.

The number of copper discoveries has declined since 2007, with no new discoveries recorded in 2022 or 2023. To combat this, mining companies are exploring new technologies such as leaching, which can recover metals from lower-grade ores. Investment in exploration technologies and focus on improving productivity are also crucial.

5. License to Operate: Building Trust and Community Engagement

Enhancing community impact and Indigenous trust remains a high priority for miners. Communities and governments expect miners to do more to support local areas and leave a positive legacy.

Companies that empower Indigenous communities as partners are creating the foundation for long-term relationships and strengthening their brand. Mine closure is another opportunity to strengthen community relationships and leave a positive legacy, but it is often overlooked. Miners must measure and report on the value they deliver to stakeholders to build trust and secure a social license to operate.

6. Rising Costs and Productivity: Balancing Efficiency and ESG

Miners continue to grapple with high costs, particularly related to labor and energy. Skills shortages are impacting productivity, with less qualified individuals taking on roles, potentially elevating safety risks. There is a growing concern that the focus on ESG is distracting from productivity, highlighting the need to better integrate the two issues. Integrating environmental metrics, such as carbon intensity, into broader productivity measures can help mining companies achieve wider benefits.

Miners are also focusing on optimizing operations and utilizing technology to manage geological uncertainty and improve asset reliability.

7. Climate Change: Meeting Emission Reduction Targets

Scrutiny around Scope 1 and 2 emissions is growing, and mining companies are under pressure to improve the transparency of their emissions and climate risk reporting. Many companies are making progress in decarbonizing operations by integrating renewable energy sources, resulting in a decline in mine-site emissions intensity.

However, achieving net-zero targets is more challenging, with difficulties in commercializing low-carbon technologies, such as green hydrogen for steel production, partly due to costs and insufficient hydrogen electrolyzer capacity. Partnering with equipment manufacturers to scale up technology is crucial, as well as adopting standardized reporting to improve transparency in supply chain emissions.

8. New Projects: Overcoming Barriers to Development

New projects face multiple complex barriers, including regulatory red tape, high costs, and a lack of skilled workers. Regulatory issues are lengthening project lead times, with lengthy delays for permits and overlapping red tape. High costs, due to inflation, lower ore grades and a lack of infrastructure, are making new mines more capital-intensive.

The increasing rate of mining royalties and taxes can be a barrier in some markets. To overcome these challenges, miners are engaging with stakeholders early in the project stages to resolve conflicts and expedite approvals and using integration across the supply chain to streamline processes.

9. Changing Business Models: Embracing Sustainability and Circularity

Mining companies are reassessing business models to capture more value and are focusing on the opportunities that sustainability presents. Companies are exploring various approaches including vertical integration into advanced materials, integration into the changing energy system, and adopting mine-to-market approaches.

Almost half of survey respondents are considering how to integrate recycling into operations, which includes using scrap or establishing collection networks. Investment in smelting and value-added processing gives miners greater control over emissions and creates opportunities for premium, cleaner products. Partnerships across the value chain are critical for achieving better outcomes, including improved logistics and lower costs.

10. Innovation: Driving Sustainable and Cost-Effective Mining

Sustainable, cost-effective mining at scale requires significant innovation, particularly as resources deplete, costs rise, talent becomes scarce, and environmental pressures increase. While investment in innovation is expected to increase, many companies are focusing on lower-risk areas such as processing rather than exploration.

Collaboration is integral to innovation, but many companies feel there isn’t enough collaboration to drive it within the sector. Partnerships between mining companies, industry associations, and other sectors are crucial for breakthrough innovations. There’s a need to foster a culture of innovation supported by leadership and an end-to-end approach.

Forward-Looking Conclusion

The mining and metals industry is at a critical juncture, with the need to meet surging demand for energy transition minerals while navigating a complex landscape of risks and opportunities.

The top 10 risks identified by EY in 2025 underscore the urgent need for transformation. Companies must embrace sustainable practices, prioritize environmental stewardship, strengthen community relations, and drive innovation to create long-term value.

Strategic partnerships, technology adoption, and a focus on operational excellence will be essential for mining and metals companies to thrive in a rapidly evolving sector.

By addressing these risks head-on and capitalizing on emerging opportunities, mining companies can confidently reshape their future and contribute to a more sustainable and prosperous world.